THE QUEST FOR BALANCE: A GUIDE TO BUILDING WEALTH AND A LIFE THAT YOU ACTUALLY WANT

When it comes to finding success and balance in life, you’ve probably been given similar advice to most other working people today. “You only get out what you put it”, “Time is money”, and other messages that sell us on the idea of working now, and a living later lifestyle that points us all to the "golden years" of retirement. This sounds good in theory, but the problem is the numbers paint a very different picture of this future (regular readers will know how much I love numbers).

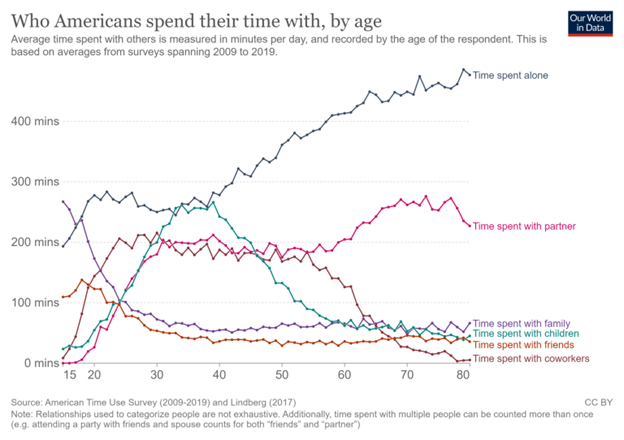

Before entering the workforce, we are sold on the idea of our "golden years." A time where we can relax, spend our time as we wish, reap the benefits of our tireless decades of work, and finally spend time with the people we care about the most. I recently came across the above graph, and it got me thinking about how the opposite is often the case. People typically look to retire in their mid 60’s[1], but as you can see on the graph above, we spend more and more time alone from the age of 40. Which correlates with a decline in time spent with others.

For many, it appears that when you’re retired, you’ll be too tired to do things like constantly travel, and your family and friends will have their own lives to attend to. All this means that retirement probably isn’t as golden as we’ve been led to believe. This tells you that in the strive for a balance between work and life, we’ve got it wrong. A life of working till you’re 65 plus and sacrificing your time for money certainly works for the company that employs you and the shareholders that own it, but does it really afford you the life that you want?

If you ask most young parents what they would do with their time if they were financially free, they will likely say they would spend more time with their kids and less time at work. Time with your children, especially when you’re young, is incredibly precious and finite - take it from me, or any other working parent. As an American culture and system, my view is that we have it backward.

The good news is that there is an equation that can help you take back control of your life by giving you more of the most valuable thing that you have - time.

Ownership Mindset

You can always create more money (just look at 2020-2021 for this), but you can never create more time. This is the great equalizer among all living creatures. However, you can spend the time that you have better. Consider the following equation:

Money = Time

Looks familiar right? This is the formula that you should apply to your life because it actually services you. Living by time=money will see you spending every spare moment that you have trying to accumulate as much money as possible at the expense of living your life. Plus, the more time you have to do what you love, and are passionate about, I would venture to say would probably bring you more money as well. A very prosperous loop!

The question is, are you taking ownership of your life or signing up for someone else's idea of it? If you look at the history of America, there is only one true asset that has typically created a proven path to wealth; ownership. By this, I mean owning businesses - be it your own or a piece of someone else's. Many of which, just so happen to be traded on public exchanges!

In doing so, you let someone else do the work to make money for you. Even if you own your own business, you may be able to hire someone that you trust to take the reigns in your place. Money should be a tool to buy you time, it shouldn’t be something that you sacrifice all of your time for. Your time is something that you can never get back, so you should use money to afford yourself more time to spend as you wish.

At the end of the day, it’s all about balance. If you don’t get up looking forward to work every day, it’s time for a change. If you want more time with your children now and you don’t want to spend your retirement waiting by your phone for them to call, it’s time to take ownership over the creation of your wealth by getting help from an expert.

Building Wealth and Saving Time

When you’re sick, you go to a doctor to get help. When your toilet breaks or you need legal advice, you go to a qualified expert for help. Why, however, don’t many do this with their finances?

Weirdly enough, investing in your future prosperity is something that many people seem hesitant to do. Taking ownership of what you do know is important, but failing to take ownership of what you don’t know will hold you back. You could, of course, try to educate yourself on all things personal finance and investing, but this will take a great deal of time - time that will be spent away from friends, family, and the other things in life that you enjoy.

If you broke your leg, you wouldn’t head to the library or sit on your phone looking up the very latest in treatment of fractured and broken bones. You’d take yourself to a hospital to get things fixed as quickly as possible.

If you’re reading this, then odds are your finances are broken to a certain degree too. The question is, will you stay on the current path that isn’t working for you or your family, or will you outsource the knowledge that you need to start your journey to sustainable wealth and take back the most valuable resource that you have - your time?

To take ownership of your life and your financial freedom, get in touch with us today!

References:

This Is When The Average American Retires- Yahoo.com

Disclosures:

This piece contains general information that is not suitable for everyone and was prepared for informational purposes only. Nothing contained herein should be construed as a solicitation to buy or sell any security or as an offer to provide investment advice. The information contained herein has been obtained from sources believed to be reliable, but the accuracy of the information cannot be guaranteed. Past performance does not guarantee any future results. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. For additional information about Julius Wealth Advisors, including its services and fees, contact us or visit adviserinfo.sec.gov.